By: Allan Parks

Product Manager, Portfolio Monitoring

April 19, 2022

The rise of the private equity due diligence questionnaire speaks to how far private capital has come as an asset class. As more investors enter the space – seeking the outsized returns promised by the private markets – they gain expertise as they continue to scale up their allocations. As they do, they begin to desire greater insight into how their potential GPs operate and acquire that insight by adding additional requests to their private equity DDQ.

What is private equity due diligence?

Due diligence is the process carried out by investors as they investigate a GP’s fund operations in order to understand if the GP is a fit for them to make an investment in their fund(s).

The Role of Due Diligence in Risk Management

Due diligence is not just a formality – it’s your shield against the unpredictable risk of the investing world. By conducting thorough due diligence, you mitigate potential risks, safeguard your investments, and make informed decisions. Whether you’re a private equity manager, a fund administrator, or a potential investor, due diligence is your compass, guiding you toward the safest route.

The Due Diligence Process

There’s a formula to a strong due diligence process. Let’s walk through it step by step.

Step 1: Define Your Objectives

Before you embark on any due diligence journey, clearly define your objectives. What are you looking to achieve? What are the potential risks?

Step 2: Identify Potential Risks

Identify potential risks and data protection concerns associated with the target company or investment. Scrutinize the third-party risk, intellectual property, and data security.

Step 3: Develop a Diligence Checklist

Create a comprehensive diligence checklist that covers all the essential aspects. This will serve as your roadmap during the process.

Step 4: Gather and Analyze Documents

Gather all relevant documents and information. Analyze them meticulously, looking for details that could be potential risks or opportunities.

Step 5: Ask the Right Questions

Leverage a comprehensive questionnaire, addressing all your concerns. Utilize due diligence questionnaire (DDQ) questions that delve deep into industry-specific practices.

Step 6: Assess Compliance

Evaluate the target company’s compliance with industry standards and applicable laws. Ensure they align with your investment strategy.

Step 7: Make an Informed Decision

After thorough evaluation and analysis, make your investment decision. Remember, the due diligence process isn’t just about spotting red flags; it’s about seizing opportunities.

What is a due diligence questionnaire (DDQ)?

Carrying out the due diligence process generally centers around a due diligence questionnaire provided by the prospective investor. The questionnaire asks about any factors that go into the GP’s management of capital – from ESG to co-investments to valuation practices – and GPs are expected to return responses to the prospective investor to assist in their investment decision.

This motivation for more data takes up a lot of investors’ time. In fact, 74% of investors claim that conducting private equity due diligence is a top-two activity which requires the greatest amount of time for their teams.

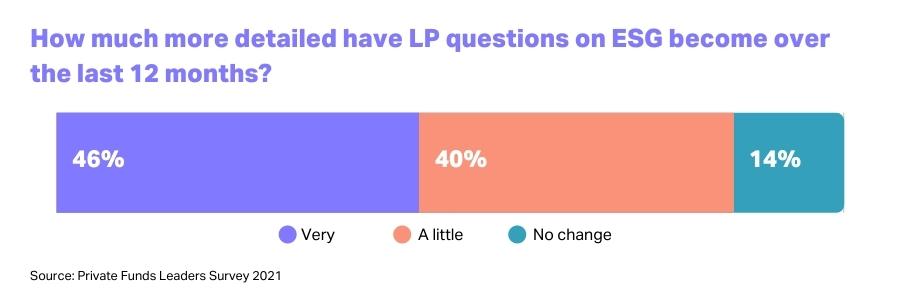

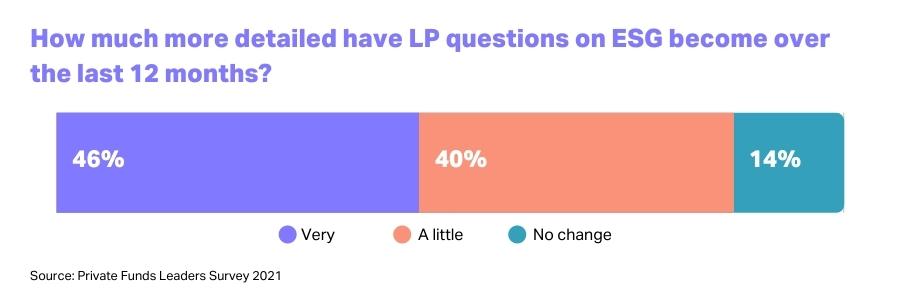

But investors aren’t alone in spending more time on due diligence. More work is also passed on to the private equity and venture capital managers they’re considering investing in, and ESG tends to be a key driver. According to New Private Markets’ 2021 Private Fund Leaders Survey, 46% of private capital managers say that LP questions on ESG have become very much more detailed over the prior year.

Private equity due diligence requires significant time investment from GPs each time they open the fundraising process, and can draw team attention away from high value tasks that could go into activities focused on creating returns for investors. Answering DDQs can be quite tedious, especially when the GP doesn’t have the data infrastructure to serve as a single source of truth for all fund data.

WATCH NOW: Enhancing your Fund and Portfolio Company Analytics

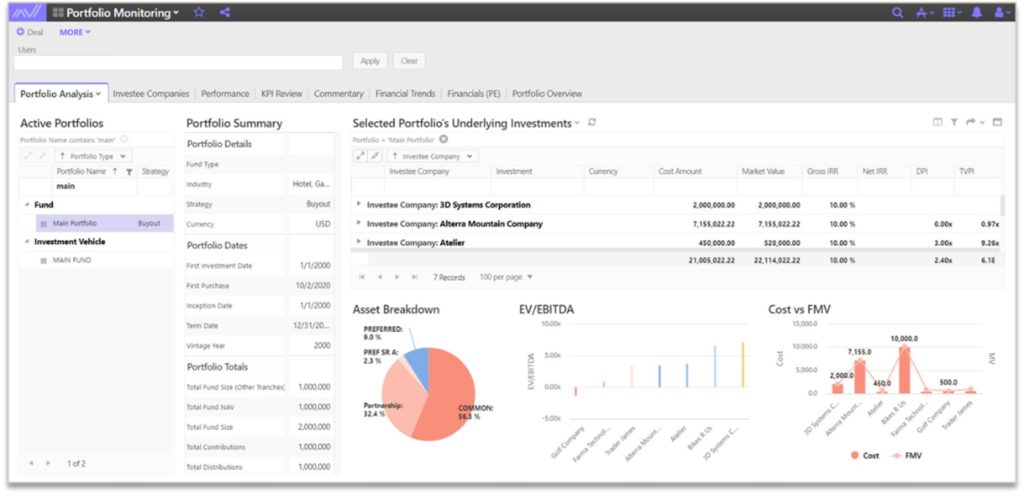

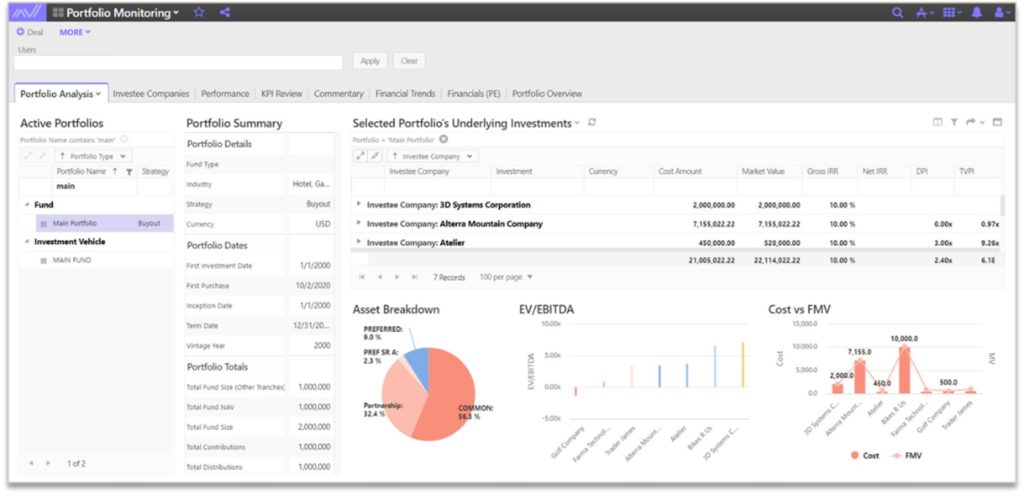

But by arming themselves with technology in the right way, GPs can drastically reduce the time spent responding to prospective investors’ due diligence questionnaires. Here’s how Allvue’s Fund Performance and Portfolio Monitoring solution helps managers optimize how they respond to private equity due diligence, ultimately saving valuable time as a firm fundraises and confirms investors for a new fund:

Allvue allows you to easily extract fund data

A core challenge for many private equity and venture capital managers when it comes to responding to investors’ due diligence questionnaires or one-off data requests is simply wrangling all the needed data. For many, it lives between different systems or different Excel documents, making it extremely time-consuming to search between multiple locations and gather it all together for one due diligence questionnaire.

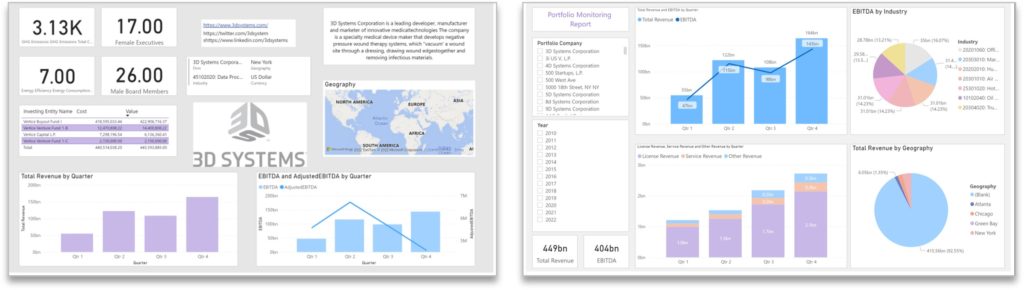

To move toward automating the private equity DDQ response process, amalgamating all data into one easy-to-access system is the key starting point. Allvue’s Fund Performance and Portfolio Monitoring is most often packaged together with our Fund Accounting solutions, allowing for it to act as a single source of truth for all of a GP’s fund metrics, drastically streamlining the portfolio data collection and analysis processes. The packaged solution provides easy access to a GP’s fund administrator, enabling the partner firm to take care of back-office activities, DDQ responses, or any other operations entrusted to them since they have a direct line to the most updated fund data.

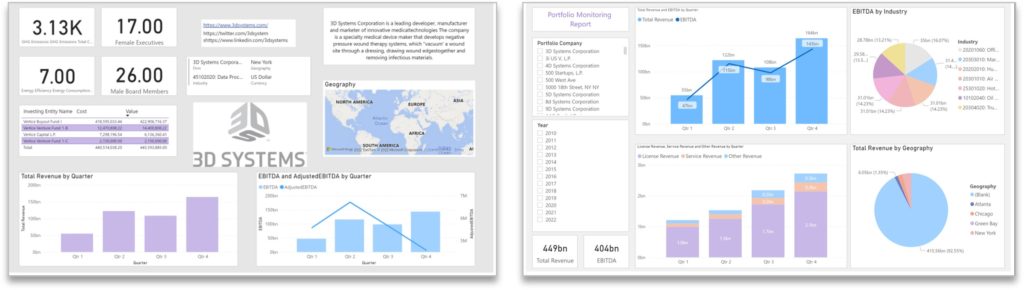

Allvue helps you build custom reports for common private equity DDQ questions

For standard private equity DDQ requests, private equity and venture capital managers can use Allvue to build a custom report to pull out the necessary data for the most commonly asked private equity due diligence questions into Excel, PDF or PowerBI.

As more and more LPs begin to lean on standardized private equity DDQ templates from the Institutional Limited Partners Association (ILPA), this feature can be a gamechanger for GPs, enabling them to complete most due diligence requests with a simple click and immediately issue it to the prospective investor.

Allvue offers a solution for qualitative due diligence questions

Not all private equity DDQs are completely based on fund metrics – many request some qualitative, written responses. This is especially the case as ESG plans come to the forefront, and many LPs seek info such as a description of a manager’s ESG investing policy or efforts the firm is taking to promote DEI measures. Using the survey builder function as part of Allvue’s Fund Performance and Portfolio Monitoring, GPs can easily digest these qualitative data requests and get them back to the investor quickly without expending manual team effort.

Using Allvue to optimize the private equity due diligence process

Private market investments are in higher demand than ever, and as more LPs become seasoned private market investors, there will be no slowdown in the barrage of private equity DDQ requests.

But this doesn’t have to mean more manual work for private equity and venture capital managers. To tackle private equity due diligence pain points as well as other portfolio monitoring challenges, Allvue’s Fund Performance and Portfolio Monitoring solution is built to empower private equity and venture capital managers to collect, use, and distribute their data far more efficiently than the average GP. Are you a private capital or venture capital manager looking to tackle due diligence questionnaires, portfolio data management, and more? Reach out today to see more of Allvue’s Fund Performance and Portfolio Monitoring solution in action.

More About The Author

Allan Parks

Product Manager, Portfolio Monitoring

Allan Parks, Product Manager of Fund Performance and Portfolio Monitoring Solution joined Allvue in 2021. Previously, he was a Product Manager of Portfolio Construction Services at Capital Group, and prior to that, a Portfolio Advisor at Merrill Lynch’s Private Banking and Investment Group where he led Private Capital (Alternative Assets) portfolio allocation for a $5Bn AUM team serving foundations, family offices and UHNW. He is a graduate of University of San Diego, he holds an MBA from Thunderbird School of Global Management (ASU), and he is a CFA Charterholder.