By: James DiCostanzo

Sales Director

October 5, 2022

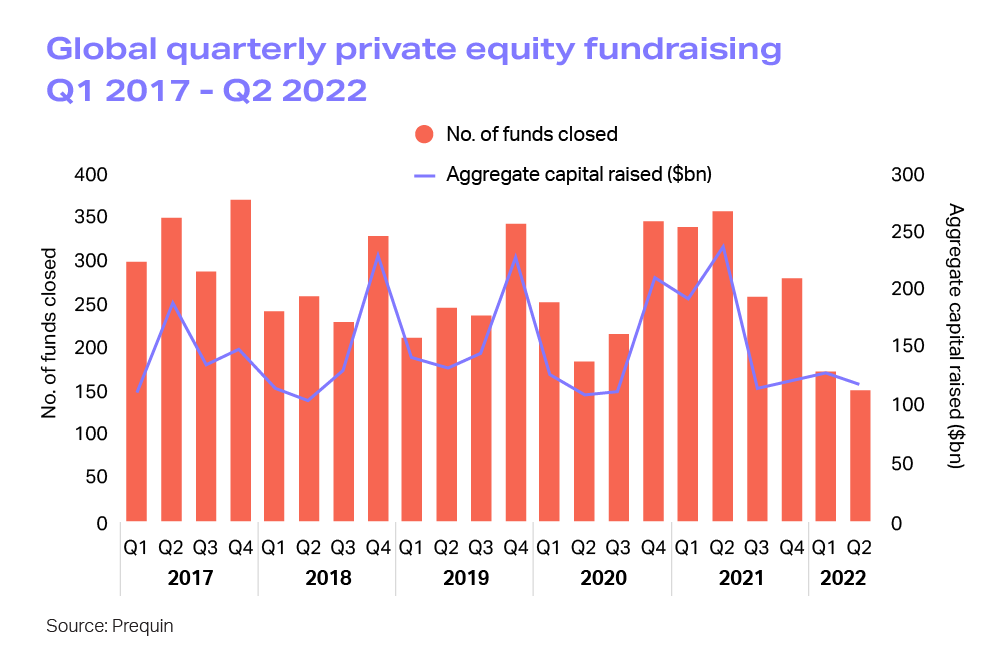

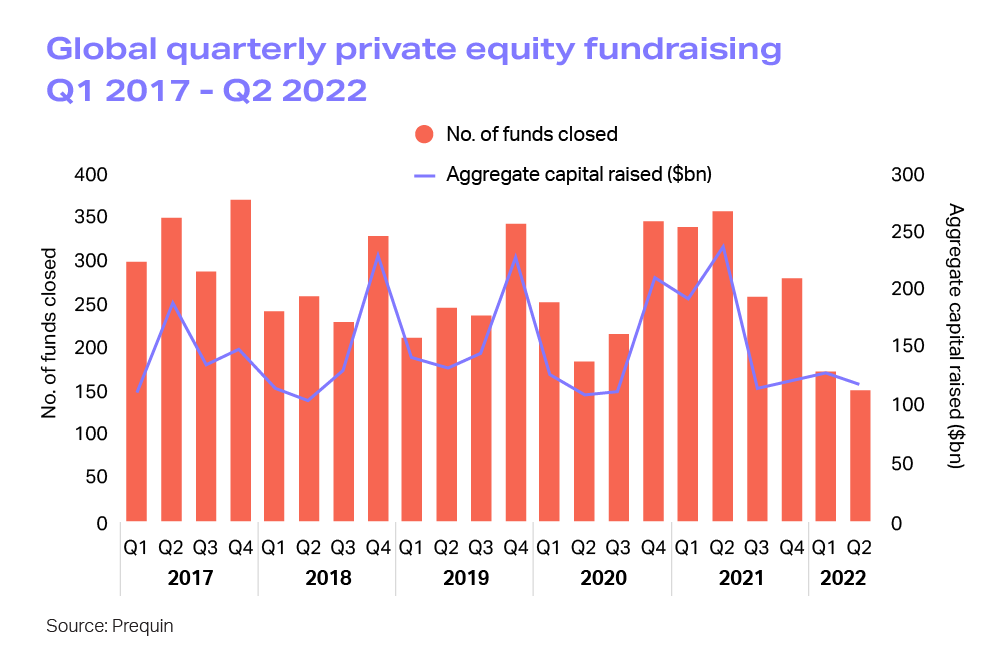

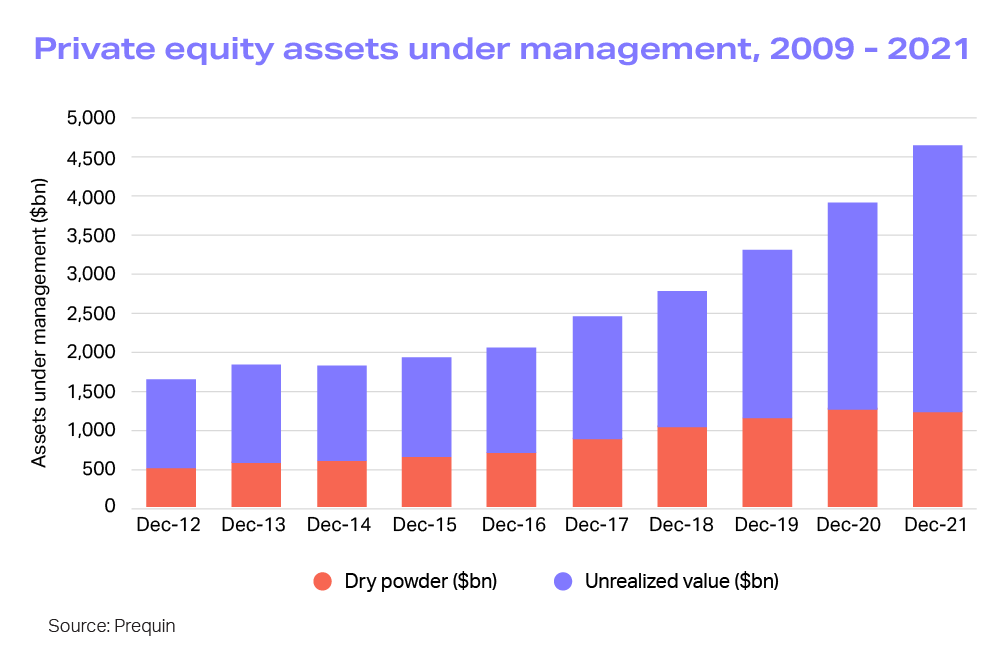

Fundraising in the private equity markets has been slower in 2022 than in 2021. In the first half of 2022, private equity funds raised $337 billion, compared to $459 billion for the first half of 2021. These declining numbers, driven in part by elevated uncertainty in the macroeconomy, lead to both volatility and opportunity in the alternative investments sector.

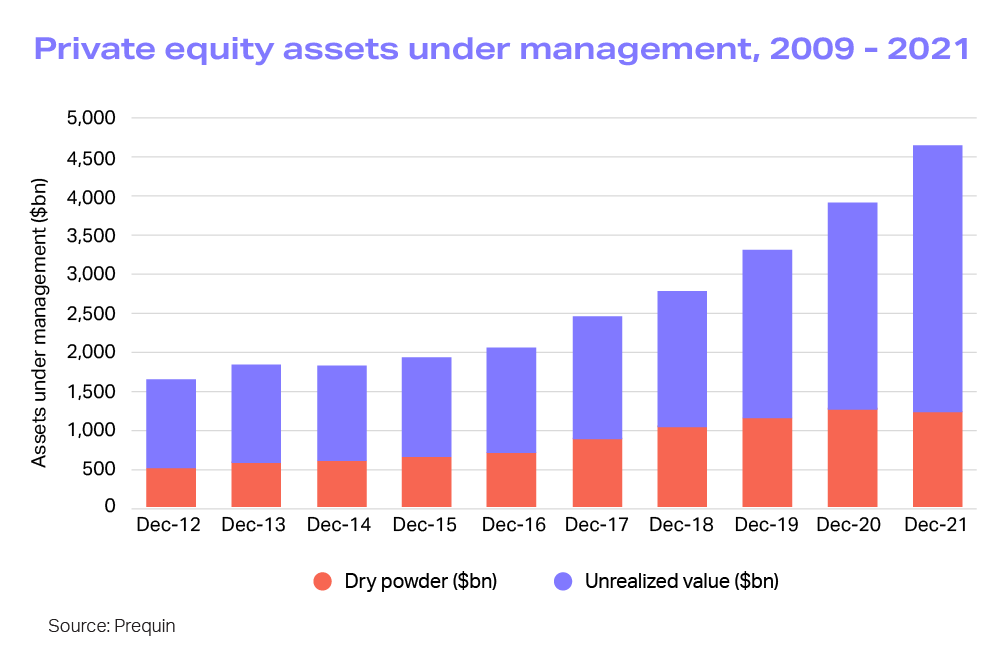

Fundraising is a challenge in any market, especially if you’re an emerging manager just starting a private equity firm. Case in point: for the first six months of 2022, 39 percent of the capital raised in private markets went to the 10 largest PE funds. Still, assets under management in this asset class remain high.

To keep pace in this competitive market, this primer on private equity fundraising breaks down fundraising fundamentals and five key steps managers can take for fundraising success.

READ INFOGRAPHIC: 6 Private Equity Trends to Watch in 2022

How does private equity fundraising work?

The tactical part of private equity fundraising is typically the second stage of the investing in private equity process, following initial conversations with limited partners (LPs) to gauge general interest and, separately, early due diligence on potential investments (such as privately held companies).

During the organization/formation stage, interested LPs will pledge capital commitments. Capital calls are completed when these pledged funds are needed for tangible opportunities.

With so many active PE firms – roughly 7,000 globally, per McKinsey – it’s important to follow strategic steps ahead of these LP conversations so that they choose to invest in you versus one of the many other fund managers. This is how private equity firms fundraise.

Step 1: Qualify how your private fund stands out

Before you begin to reach out to potential investors, it’s helpful to develop a value proposition that makes limited partners consider you as an option for their investments. This can be a short, simple statement that indicates what specific benefits your firm has compared to other private markets managers.

Maybe it’s technical expertise, previous experience of your principals, a specific investment strategy, or a niche industry or geographical focus. Focus on what sets you apart (your key differentiators) and why you’re the best at what you do (your competitive advantage). If you don’t stand out, raising the initial capital needed to get off the ground will be challenging.

As part of this process, you should perform your own due diligence. Who are your top competitors that are already up-and-running, and how can you differentiate yourself? If you’ve decided to focus on specific asset classes (venture capital or fund of funds, for example), what risks are involved and how will you address them? You’ll want to think beyond the obvious risk of market/economic volatility and consider other factors, such as funding, liquidity, and capital risks.

READ MORE: How GPs can Stand Out in a Hot Fundraising Market

Step 2: Determine the details

Like any other business launch, the devil’s in the details when it comes to starting a private equity firm. Here are some basics you’ll want to decide on before beginning your fundraising discussions.

Key considerations for a new private equity fund

- Fund size: Your target investment strategy will help inform your fund size. Review the market cap of your prospective portfolio companies and consider how much you hope to invest. From there, you can calculate how many LPs you want (and how much you’ll need them to chip in).

- Fee structure: Typically, GPs charge LPs between 1.5% and 2% of committed capital to pay for overhead costs. As an early-stage fund manager in the initial rounds of PE fundraising, however, many choose to reduce this fee for prospective partners (taking only 1.25%, for example). Once you have a proven track record, you can always adjust.

Successful firms have recently begun to charge more than 2%, with some management fees as high as 3.5%.

- Track record: Speaking of your track record, what do you plan to calculate and share with investors? Private equity return measures generally include net internal rate of return (Net IRR), total value to paid capital (TVPI) or total value to paid-in, and distributions to paid capital (DPI). Depending on your stated objectives, these results can be calculated at the port co level, the portfolio level, or the fund level.

You’ll also want to consider your reporting functionality – what will your reports look like, and will they be available to your LPs on-demand? While Excel or QuickBooks might be sufficient as you get started, these solutions are prone to human error and aren’t particularly scalable for your investor relations team.

We’ve recognized a clear need among startup and emerging managers – a software package that can scale in complexity alongside a burgeoning firm – and leveraged our experience with enterprise-level clients to build the Allvue Equity Essentials software set. This suite caters to the needs of new and emerging private equity and venture capital firms, providing solutions for accounting, reporting, and investor communications, plus real-time performance metrics to help streamline fundraising efforts.

DOWNLOAD WHITEPAPER: 5 Steps Emerging Private Equity & Venture Capital Firms Can Take to Accelerate Growth

Step 3: Appoint your fundraising team

PE fundraising is ultimately a people business, so you’ll want to have the right team in the room as part of any discussions with potential LPs. Anyone in the conversations should be prepared to confidently discuss their relevant experience, including any past achievements that can be supported by data (deal origination, investment performance, timing, etc.)

Depending on the size of your firm at launch, your fundraising team might include the CEO, COO, Chief Investment Officer, and Chief Compliance Officer, along with any relevant support staff that can speak to your differentiating factors.

Step 4: Find your first private equity investors

Once you’ve set up shop and figured out the above details, you’ll want to consider committing your own capital if it’s possible to do so. Most GPs do invest in their funds, typically 1% to 2%. One benefit to contributing your own capital is that it shows potential investors that you have “skin in the game.”

Then, it’s time to start fundraising in earnest. There’s nothing wrong with starting with trusted friends, family, and colleagues – even if the conversations are just for practice! Your network is the best place to find trusted investment partners.

You’ll eventually want to have a relatively diverse group of limited partners from the following segments:

- Patient (long-term) capital: Large institutional investors – such as private foundations, pensions, or endowments — are considered patient capital. These organizations may be more conservative as to what they’ll invest in (leading to longer due diligence periods) but they are typically reliable and have ample cash on hand. Additionally, some pension funds and endowments have launched “emerging manager programs,” allocating a certain percentage of their threshold to smaller or newer managers.

READ MORE: The Ultimate List of Emerging Manager Programs

- Value-add capital: Value-add capital investors help out behind the scenes with identifying deals and managing them. Often, these are high-net-worth individuals with PE experience.

- Flexible capital: Often in the form of fund of funds or family offices, these investors have available cash but typically hope for quick returns.

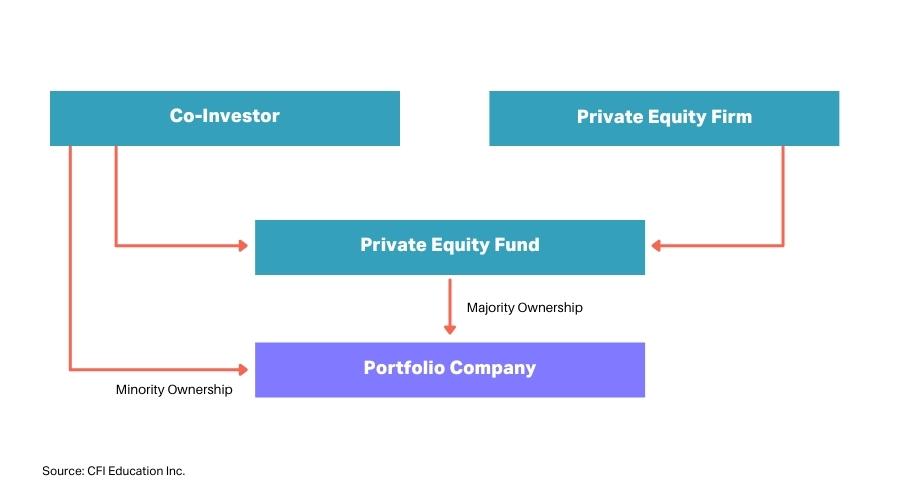

What is co-investing?

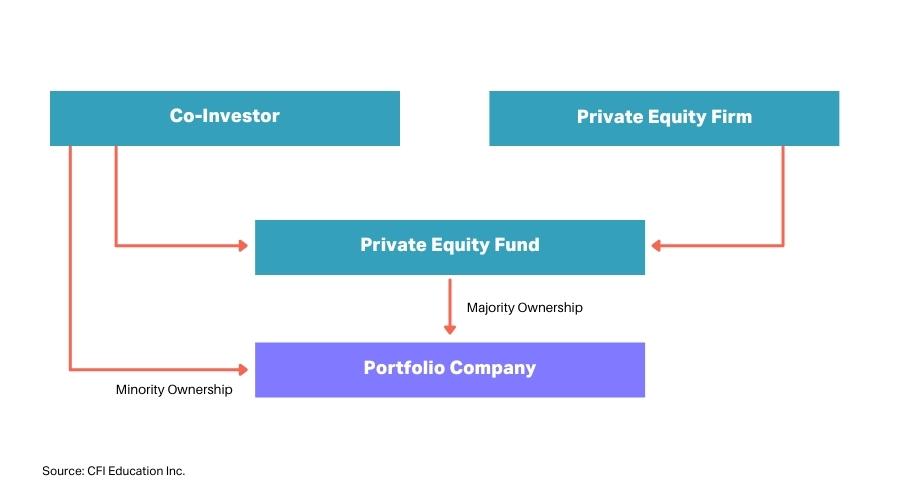

Managers who are just starting a private equity firm might consider discussing co-investing as an option. This transaction occurs as limited partners invest alongside the PE fund rather than through the fund. This arrangement provides additional capital to PE firms (useful for those in startup or emerging mode) while giving LPs ownership privileges and a reduced fee.

Step 5: Equip yourself for success

PE fundraising is challenging and frustrating, but a vital (and rewarding) part of starting a private equity firm. These steps are far from the end of the journey, which will also include marketing yourself, tracking your investments, and communicating on a regular cadence with the partners you make. Having the right technology to support and streamline your efforts can make a world of difference. See how Allvue can help.

Conclusion

Private equity is a dynamic and lucrative field that offers opportunities for both private equity firms and investors. By understanding the nuances of fundraising and investor relations, managers can navigate this complex landscape with confidence.

At Allvue, we’re committed to providing innovative solutions and insights to empower your private equity journey. If you’re a private equity firm looking to strengthen investor relationships, our mission is to support you in making informed decisions and achieving success in the private capital space.

Unlock the potential of private equity fundraising, investor relations, and deals with Allvue, your trusted partner in the world of alternative investments.

More About The Author

James DiCostanzo

Sales Director

James DiCostanzo is a global sales leader with over 20 years of experience in the financial, private equity and SaaS industries. He is currently the Global Head of Growth Equity Sales at Allvue Systems, a leading provider of investment management solutions. He joined Allvue Systems in March 2020 as the Head of Sales for the East Region, after working at Thomson Reuters for nearly two decades in various roles, including Head of Solution Specialists, Data & Analytics and Global Business Director. He has a bachelor’s degree in Business/Managerial Economics from SUNY Oneonta. He is based in the New York City Metropolitan Area and can be found on LinkedIn at https://www.linkedin.com/in/jamesdicostanzo/.