By: Allvue Team

October 11, 2022

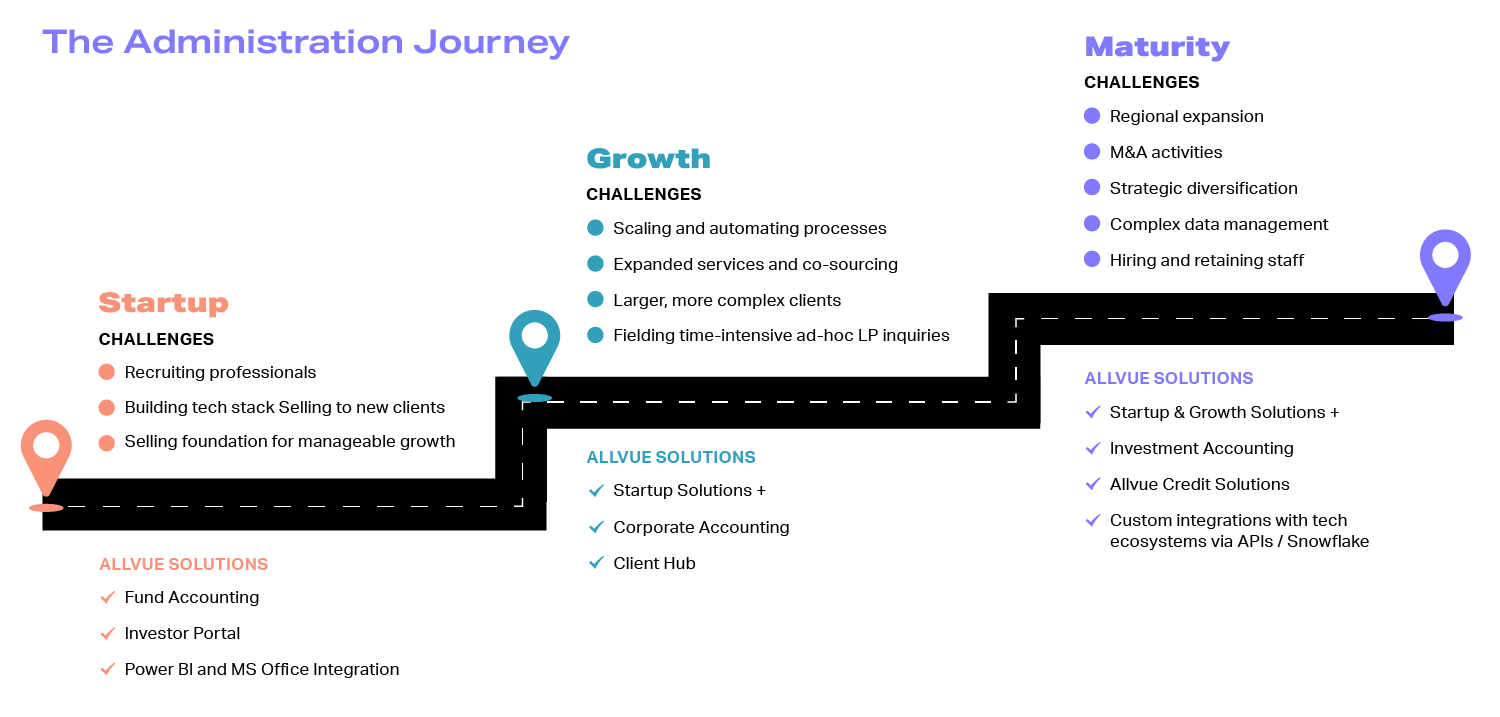

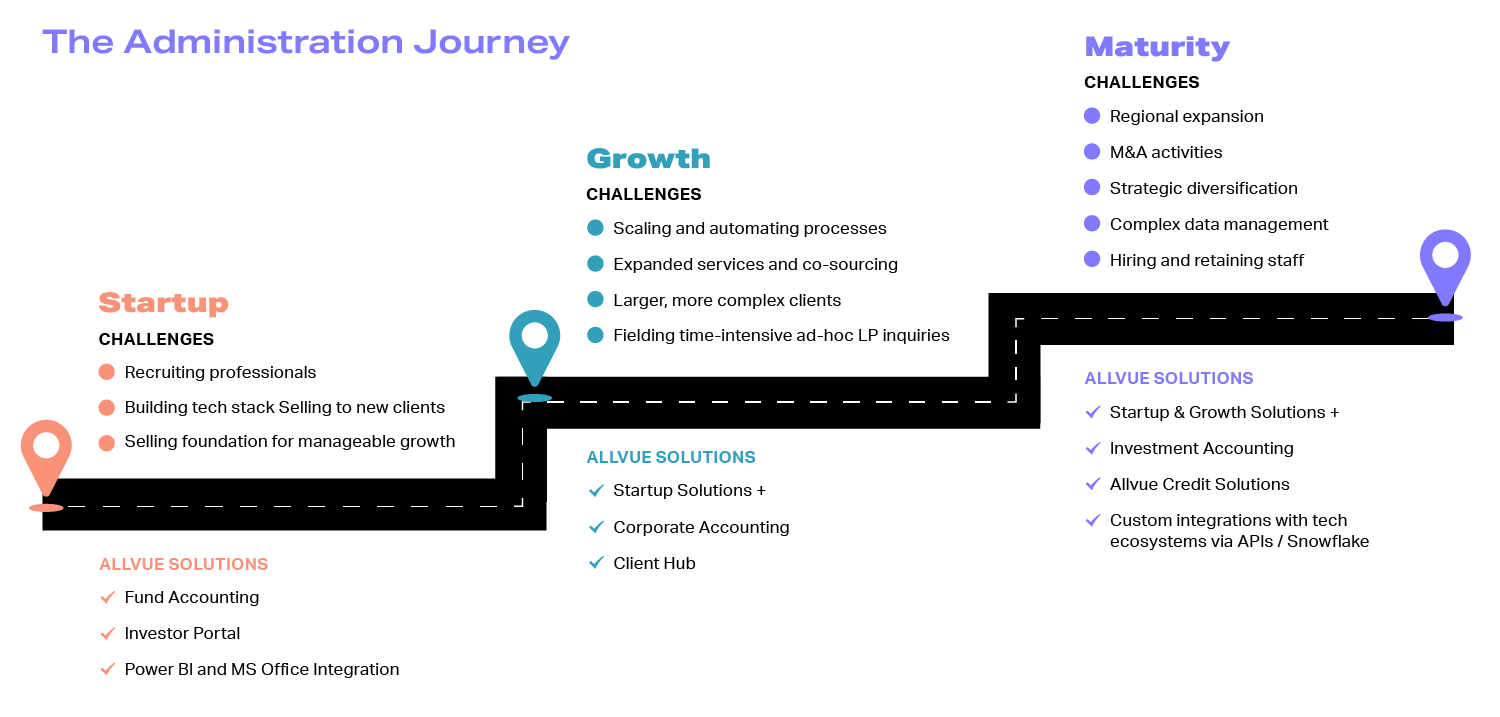

At Allvue, we see PE fund administrators as trusted partners on our quest to empower private equity and venture capital firms to make superior investment decisions. We’ve supported a wide variety of fund administrators through different stages of their development. As firms progress from startup to maturity, adding services and new types of clients, Allvue is able to support them and their clients.

This article describes the characteristics of each growth phase and discusses how Allvue’s comprehensive product suite can help fund administrators thrive, whether they are still in formation or have been around for years.

Startup fund administrators: Building a foundation for growth

The new entrants in fund administration usually have experience in the industry and a vision for helping fund managers operate better. Many new administrators are formed by legal or accounting firms looking to expand their offerings for investment company clients. Others emerge when a fund company spins out its own administrative group. Still others are created by entrepreneurs who are familiar with the industry and have an idea for a new approach by a new firm.

| Sources of Fund Administration Firms |

| Professional services companies adding new business lines |

| Fund companies spinning out their administrative units |

| Entrepreneurs who know the industry and have an idea for a new approach |

Like all startups, fund administration companies in launch mode worry about raising startup capital, recruiting a top-notch staff, and selling to new clients. The founders often launch off their existing expertise, working in just one region of the world and one type of investment strategy. While their initial services may be limited in scope, founders look for ways to work sustainably so that they can scale.

Fund administrators intending to be best-in-class service providers need best-in-class tools. Allvue offers just that, with tools that scale up for the largest administrators and down to work with start-ups. Our true general ledger provides a single source of truth for all alternative investment data, in any currency or asset class. Your clients can maintain simple workflows no matter how complex their portfolios become. New regulations and changing client demand will make the market even more complex. These call for ongoing technological investment to serve customers. Allvue’s future-proof technology and commitment to the industry help you stay on top of the game.

Growth fun administrators: Scaling up accounts, services, and complexity

As administrative services firms move out of the startup phase, they take on more: more accounts; more professionals; more services; more complexity.

The next challenge is how to differentiate the firm in a competitive market. The growth-stage fund administrator has new entrants nipping at the heels as it starts running with the bigger players, who are growing even bigger thanks to mergers and acquisitions.

Allvue can help growth-stage fund administrators streamline processes so that they can keep growing while differentiating themselves from the competition. Through co-sourcing—working through an instance of the client’s back-office system—administrators can add new customers without increasing the technology load. With co-sourcing, the fund maintains the technology and ready access to the data (thanks to Allvue’s single general ledger), and the administrator logs in to perform the work. For many funds and administrators, a co-sourced arrangement eliminates the tradeoffs between handing administration in-house and outsourcing it.

For administrators and funds that prefer traditional outsourced relationships, Allvue’s Client Hub offers a better way for administrators to collaborate with clients, leading to a better, deeper relationship. Client Hub gives an administrator’s clients ready access to reports, documents, and Power BI dashboards related to the fund. Administrators don’t have to field data requests, an

Mature fund administrators: New markets and services

When a private equity fund administrator matures, the firm has a complete slate of services and a new set of challenges. Maturity is not a synonym for stagnation! Rather, it’s an opportunity to bring refined skills to new markets. Building a reputation is hard work. Once it is in place, expansion is much easier.

Depending on its strategy, mature administrators may opt to continue growth by opening offices in a new region of the world, acquiring a competitor, or adding back-office capabilities to handle private debt. Allvue’s Investment Accounting solution fully integrates with our Fund Accounting solution, so administrators can handle both equity and debt on a single, streamlined platform without the risk of duplicate entry or mismatched data.

Hiring and retaining staff is another challenge for fund administrators. Allvue’s industry standard tech stack and associated tools such as Power BI, Sharepoint, and Snowflake help with the hiring process because top candidates are likely to have the relevant experience. New hires don’t have to learn proprietary code before they can be successful.

Standish Management, a fund administrator working with private equity funds, uses Allvue to support its work for over 1,200 entities and report to more than 25,000 limited partners. It leverages Allvue for both outsourced and co-sourced deployments, depending on the services that best fit each client. The power and flexibility of Allvue’s platform helps Standish focus on its core expertise and offer clients individualized services.

“At Standish, our goal is to provide clients with a seamless, customized experience that responds to their needs, and that’s why we chose Allvue’s solution set. With Allvue, we’re able to quickly and easily meet their needs and requests in a bespoke way, and really help support their success.”

-Susan Gillick, President of Standish Management, LLC

Allvue takes you to the next level

No matter where you are in your growth cycle, Allvue can help you scale processes and reduce risk. Our customizable solution addresses the entire investment lifecycle in a framework built on Microsoft’s enterprise framework for sustainability. Whether your firm is a startup building a foundation of top-notch accounting services, a growth firm looking to pull ahead of the pack by working with more complex assets and funds, or a mature firm honing its edge in global markets, Allvue has a solution. Our platform was created specifically for the complexities of the private market to help you evolve from a third-party vendor to an indispensable partner.

Register for a custom demo to find out how Allvue’s software solutions can take your fund administration business to the next level.