By: Allan Parks

Product Manager, Portfolio Monitoring

April 28, 2022

Venture capital valuation and reporting, while essential to fund operations and investor relations, are challenging and time-consuming undertakings no matter which way you slice it. The most common pain points revolve around the timing of financing rounds and the opaque nature of private market data.

VCs must collect, analyze, and monitor data across large, complex portfolios. And with VC valuations under scrutiny as industry onlookers question whether a bubble is about to burst, and as the U.S. Securities and Exchange Commission has proposed a rule requiring new data disclosures from private funds, there is naturally extra attention on venture capital reporting as of late.

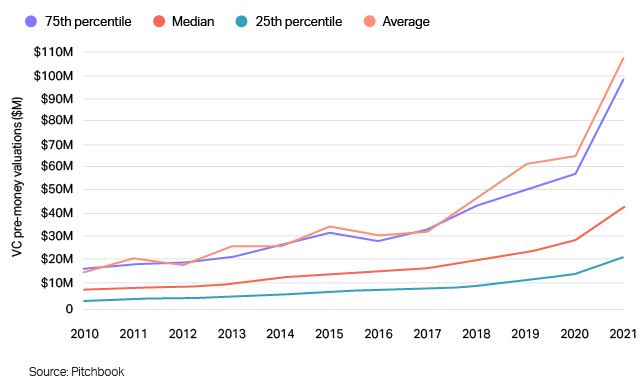

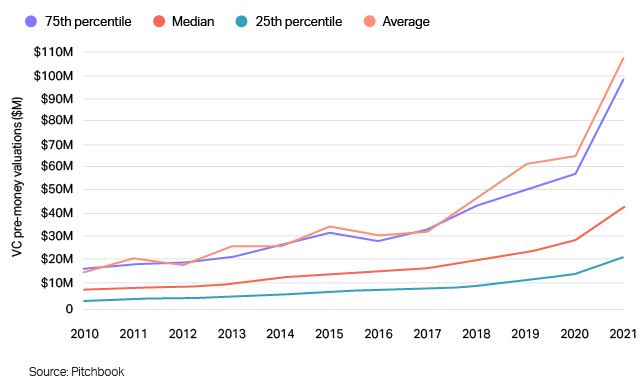

Early-stage VC valuations spike to new heights

Without the right data processes and infrastructure in place, VC managers face a variety of risks – risk of reporting errors, risk of reputation hit for valuation errors, risk of investor mistrust and eventual churn. But by overhauling their venture capital reporting and valuation workflows, managers can feel confident they’re reporting on their funds with integrity and reap efficiency gains in the process.

How to rebuild your venture capital valuation and reporting process

Improving VC valuations and reporting processes all comes down to the building blocks – data. But rethinking such fundamental aspects of fund operations is certainly challenging. Here are the keys steps to consider:

Simplify your data collection process

Keeping track of your portfolio companies’ financials and KPI submissions during recurring reporting cycles can be a difficult task, especially since VCs’ portfolios are becoming larger and increasingly complex. Integrating disparate single-point solutions can be difficult and time-consuming, opening VCs up to errors and incomplete cap table round data and adding inefficiency to the mix. Ultimately, spreadsheets are not optimal for handling more than a handful of similar fund types.

Instead, VCs need a way to automate workflows, and leverage tools that provide ready-made templates and KPIs. Along with this, the flexibility to add custom KPIs, maintain detailed cap table reporting, and create their own workflows quickly and easily will help VCs systematize processes and reduce time spent on repetitive tasks.

VCs should look for a fully integrated solution that can provide them with data collection capabilities that are automated, customizable, and that streamline workflows. Solutions that also provide automated notifications with status tracking as well as tools to create and manage custom templates for each company will free them up to concentrate on higher-value tasks. Finally, a comprehensive library of pre-built KPIs — including those for improved ESG due diligence — along with a built-in KPI builder helps managers create their own KPIs quickly and bypass busy work.

Taken together, these functionalities let VCs focus on value-added work and spend less time troubleshooting venture capital reporting issues.

Improve your data analysis

Once VCs have straightened out their data collection workflows, it’s time to turn attention to how they pull insights from that data. VCs require the flexibility to analyze fund and port co (holdings) level data and provide that data to stakeholders quickly and efficiently.

To do so, it’s imperative they organize data they collect in a single instance, consolidating the information so they can quickly assess the state of their portfolios. Without a holistic view of portfolio performance from individual holdings to fund level in one solution, it becomes difficult to make sense of the data they have. Each team within the VC requires up-to-date data access and usability features that will enable them to fundraise effectively, track performance against projections, monitor fund performance, exposure, and risk, and respond speedily to investor queries, among other tasks.

By utilizing fully integrated technology that supports a consolidated front-end for monitoring and analysis, deal teams can easily share information across the organization, ensuring that everyone stays on track.

Further, VCs should adopt a technology solution that allows them to monitor trends across a number of KPIs, integrates information across all individual holdings, industries, geographies, asset classes, and portfolio types, and integrates external data sources to provide a more comprehensive picture of their investments. Lastly, business intelligence and data management capabilities will allow them to drill down into asset level details and build customized visuals so they can satisfy their needs for information quickly.

By gaining easier access to this data and being able to proactively offer it to investors, VCs will face fewer questions and tacked-on data requests to the VC valuation and performance reporting they provide to investors.

Optimize your venture capital reporting

In order to share port co and fund data quickly from front to back office, VCs need high quality, timely, and accurate internal reporting in order to make strategic and timely investment decisions. They must provide internal stakeholders, operating partners, and GP leadership with both qualitative and quantitative information while customizing the level of detail to best suit the needs of each stakeholder.

A solution that solves the reporting conundrum — “how do I generate more and better reports that internal stakeholders need without elevating headcount and costs?” — will be an important consideration in choosing an end-to-end technology system.

Some of the features VCs should look for include:

- Standard and custom analytics and dashboards

- Automated report distribution to both internal stakeholders and investors

- Self-service options that allow stakeholders to generate ad hoc reports as needed

Streamline your venture capital reporting

Once VCs are able to optimize their reporting process, they’ll need a dependable way to distribute that information to LPs and external stakeholders in a regular and timely manner. Providing up-to-date investor reporting is no small task; it can cause a fund’s IR team to spend an inordinate amount of time addressing multiple queries – both standard and ad hoc – preventing them from concentrating on higher level tasks.

Successfully meeting this challenge requires tools such as customized dashboards so IR teams can quickly answer ad hoc queries and grant investors access to self-service reporting tools, as well as an investor portal that LPs can leverage to easily to access their information. With an investor portal, standard and customizable automated LP reports can be distributed directly to LPs, and access to supplemental reporting on financials and portfolio information at the fund level can be configured on a custom basis, providing a self-service element to the process.

The result is that LPs will be able to access the information they seek without added headcount or extra manual work on the part of the GP.

How Allvue helps with venture capital valuations and reporting

With Allvue’s Fund Performance & Portfolio Monitoring solution, VCs can turn data into actionable information so they can focus on sourcing capital and managing their portfolio, rather than putting outsized time and attention into their venture capital valuations and performance reporting.

FPPM collects and consolidates financing round data, valuation data, and operating KPIs, and then integrates them, empowering all VC stakeholders across the firm to make superior investment decisions. Our solution utilizes a cloud-based, intuitive platform that gives VCs powerful analytics and configurable, fully integrated reporting and dashboarding tools, so they can take full control of their portfolio.

With extensive venture capital reporting capabilities and business intelligence integration, spotting trends at the company or fund level is just a click away. Reach out to learn more today.

More About The Author

Allan Parks

Product Manager, Portfolio Monitoring

Allan Parks, Product Manager of Fund Performance and Portfolio Monitoring Solution joined Allvue in 2021. Previously, he was a Product Manager of Portfolio Construction Services at Capital Group, and prior to that, a Portfolio Advisor at Merrill Lynch’s Private Banking and Investment Group where he led Private Capital (Alternative Assets) portfolio allocation for a $5Bn AUM team serving foundations, family offices and UHNW. He is a graduate of University of San Diego, he holds an MBA from Thunderbird School of Global Management (ASU), and he is a CFA Charterholder.