By: Allvue Team

March 24, 2020

Financial uncertainty across the private capital spectrum

With the global economy facing significant economic headwinds from the onset of the Coronavirus, private capital firms are facing their own challenges in how they manage their portfolio companies, loan portfolios, investor communications and fundraising efforts. There will be obvious implications to free cash flows, changes to EBITDA and breaches to loan covenants, particularly to cyclical and highly leveraged companies. What’s also becoming quite apparent, though, is how the pandemic is changing the day-to-day operations of GPs across the world, with deal activity coming to a halt and investors clamoring for information on how changing financial conditions are affecting their investments. The expedited transfer of information both inside the firm as well with investors, portfolio companies and operating partners will become vital.

Loan management: streamline the entire investment lifecycle

With a number of companies looking at a potential cash crunch, sponsors are encouraging portfolio companies to draw down on their lines of credit to manage their financial positions. Of course, for private debt firms, more leverage on the balance sheet has the potential to change re-payment abilities, with covenant agreements coming under scrutiny. Moody’s, for their part, recently upped their projected default rate to 3.6% for 2020 year-end, with a worst-case scenario of 9.7%. Credit and loan markets are clearly under stress with debt servicing for many industries and companies now in question. CLO managers are now looking for credit or loan management software to ease the burden of their workloads and empower better investment decisions.

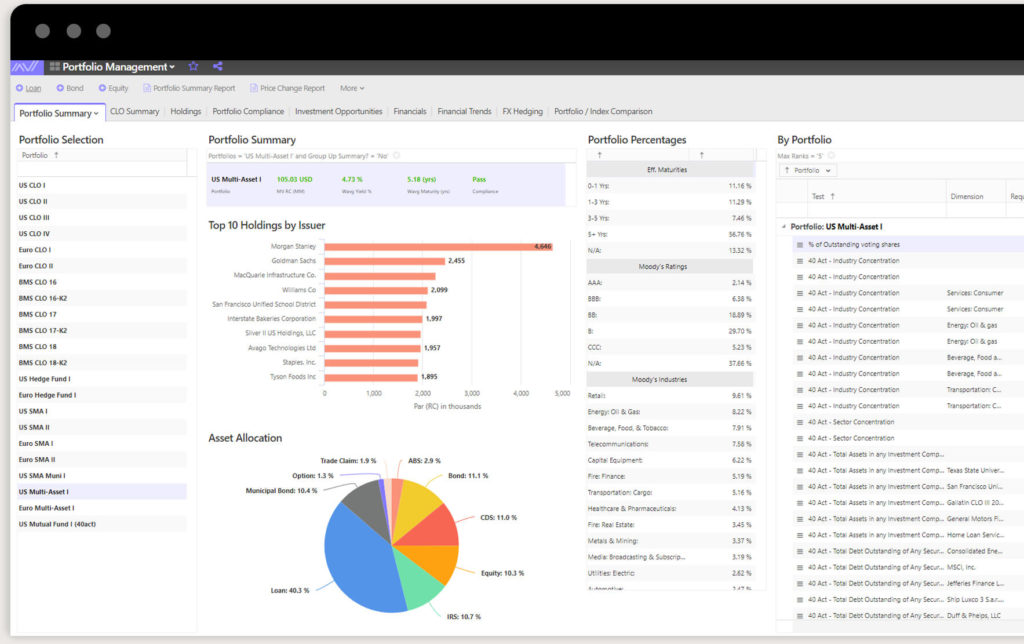

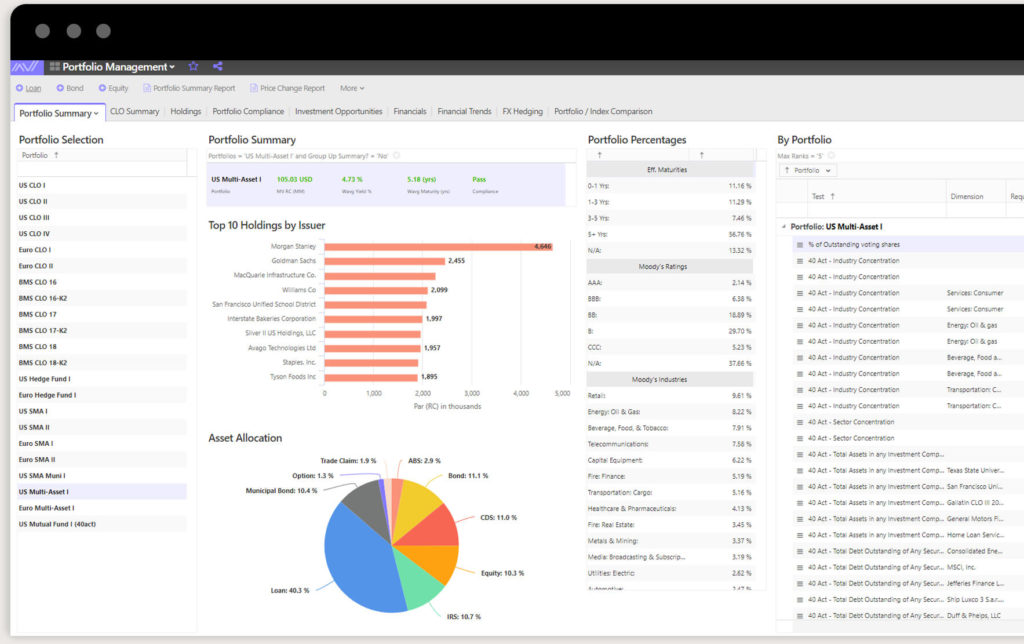

Portfolio management: manage your exposures and risk in a single place

In times of economic stress, portfolio management systems become an invaluable tool for private debt and direct lending managers to monitor the financial health of their borrowers. Such tools allow portfolio managers to have a better understanding of their positioning, exposure and risks. The breadth and depth of such systems can vary widely, however. Ideally, the best systems are going to provide users with 1) flexibility to model their investment processes while maintaining workflow rules, 2) the ability to move easily from portfolio to position-level analysis, 3) have integration capabilities between other internal systems as well as with external data vendors and counter-parties and 4) ability to stress test their portfolio’s investment guidelines and portfolio metrics with default and rating scenarios that highlight where the investment team should maintain their focus. Given the dramatic changes in both the economy and credit markets these days, the breadth and depth of analysis that a portfolio management system can provide is what will facilitate decision making by the investment team. Key functions can, and should include:

- Customized views so PMs can zero in on certain portfolios, industries, maturities, spreads or any attribute for quick analysis

- Financial statement analysis with the ability to both upload and download from MS Excel

- Covenant analysis including the ability to model forward looking projections

- Cap table analysis so lenders can track portfolio companies that are taking on more debt in the face of cash flow and liquidity issues

- Borrowing Base and fund investment analysis to help maintain compliance and ensure that lines of credit are not overextended

- Peer group analysis (including third-party vendor data feeds) to monitor financial comparables

- Ability to quickly work through funding and loan accounting processes to accurately track outstanding payables and receivables to ensure that there is appropriate liquidity to run the business

Distressed debt investing: make rapid, informed investment decisions

While stresses resulting from the virus outbreak are affecting companies of all sizes across the globe, the enormous amount of dry powder accumulated by private capital firms may find soon find itself facing a plethora of opportunities. Private equity distressed managers, long waiting to spring capital, have accumulated $77 billion in assets as of 2019, with a number of large managers having recently raised new funds ready for deployment. Lower stock prices also make take-private deals more attractive. For private debt managers focused on distressed debt and turnaround situations, that number was approximately $66 billion according to Pitchbook.

With banks focused on their own balance sheets and reluctant to expand their loan capabilities (government support notwithstanding), a pull-back in the economy could bode well for private debt firms to step in and extend their presence in the direct lending market.

Deal pipeline management: track opportunities across every channel of communication

For both credit and equity managers, it’s going to become imperative for investment teams to manage their deal and opportunity pipeline judiciously. There will no doubt be significant competition for deals given the amount of capital at the ready, so GPs would be wise to make sure their deal review processes are in place and ascertain where technology can support the deal management and review process.

Investor relations: maximize relationships

As much as the focus these days has been on the volatility in the public markets, you can be sure LPs are reaching out to their private equity and debt managers to see where any potential cracks are in their portfolios. Investor relations teams are working overtime fielding calls from nervous investors like:

“What companies in the fund have exposure to European supply chains?” “Are there any companies in the portfolio at risk of default?”, “What are the biggest risks to the fund right now?”, “What opportunities do you see down the line to deploy capital?”

Institutional investors have long memories and echoes of the financial crisis in 2008-2009 are rearing their heads. Of course, LPs have limited options other than the secondary markets to adjust their private capital portfolios but managing projected cashflows is an important part of portfolio allocation. For years now, LPs have been pushing their fund managers for more transparency, and with the potential for a recession brought on by the virus outbreak, that will only intensify investor’s need for information. GPs, for their part, would do well to ensure that their technology can support the expedited movement of information from the back office to the front office to investor. CRM and Investor Portal solutions to help manage investor communications along with flexible reporting tools that can extract the data that LPs are requesting are vitally important to facilitate the flow of information from fund manager to LP.

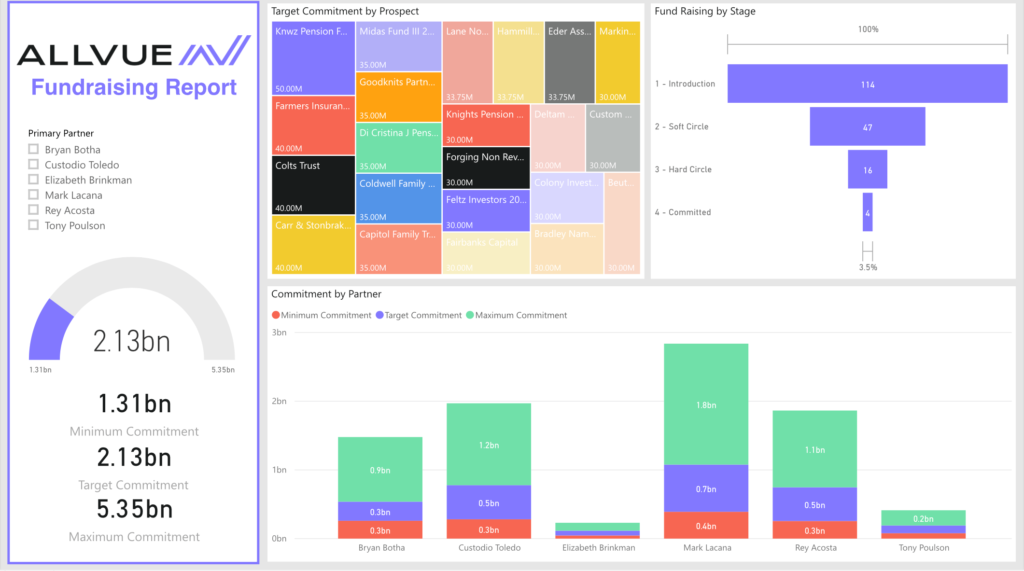

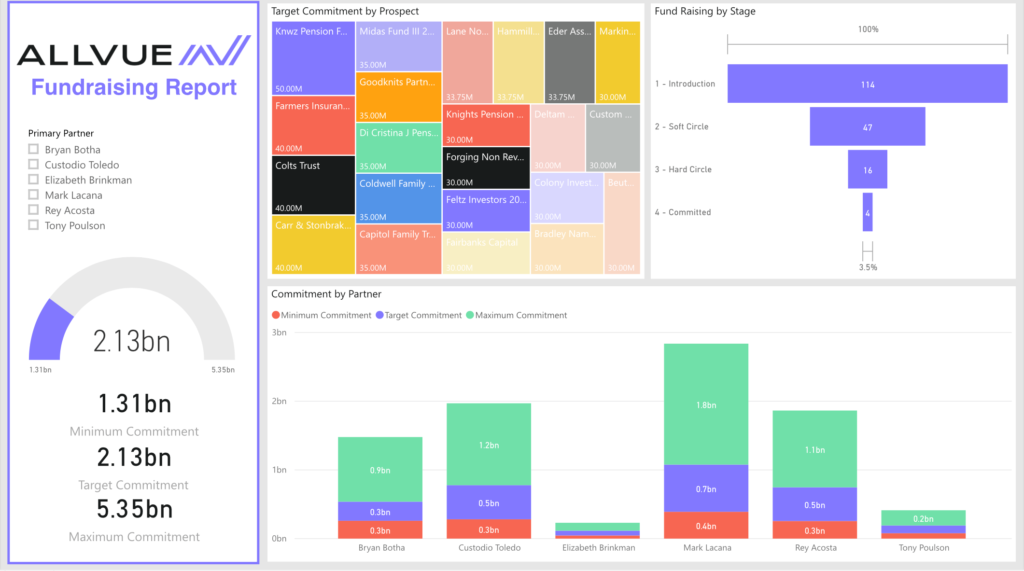

Fundraising intelligence: identify trends with advanced data visualization

With restrictions on travel being put in place across the globe, disruptions to fundraising are clearly taking place as meetings get cancelled, or at least, pushed back. Re-upping current investors, already having done firm and previous fund due diligence, is certainly an easier path to secure new commitments. Fundraising from new investors, however, could pose more challenging as in-person meetings are delayed. Given current situations, investor relations and business development teams would be well advised to look to enhancing their communications technology to facilitate their fundraising processes. Having an industry-specific CRM in place to track prospective investor communication is widely considered a minimum solution in the best of times. To truly understand fundraising progress, though, many GPs have turned to business intelligence-type of solutions to uncover the details of where fundraising success is occurring, and where it is not.

Being able to ‘slice and dice’ across personnel, investor types and stage, can enable management to allocate time and resources where it’s going to have the greatest impact in reaching a target fundraise amount.

As important it is for fund managers to utilize an investor portal to communicate with their investors as to portfolio and fund developments, communicating with prospects via a fundraising portal can be an enormous asset in managing fundraising documents. As LPs are hyper-focused these days in managing risk and liquidity in their portfolios, GPs in the market would do well to make it as easy as possible for investors to access, organize and retrieve the collateral they need to facilitate allocation decisions.

Management company P/L

The long-term business and economic implications resulting from impact of the Coronavirus are still unknown, but it’s becoming apparent that changes in the global economy happening now will ripple through the private markets, forcing GPs to alter their business plans and 2020 assumptions. Possible implications include:

- Revenue from management fees and/or carried interest has the potential to substantially drop if there is a longer-term effect on fund IRRs from the deterioration of portfolio company performance.

- The change to borrowing costs to finance deals and their effect on the bottom line

- A shift from changes in short-term expenses (i.e.: reduction in travel), but other types of expenses potentially rising (i.e.: increase of insurance coverage, legal fees)

- The projected income from new funds being raised that may have to be significantly postponed given delays in fundraising.

Implementing an industry-specific management company accounting solution – one that can integrate with a GP’s fund accounting solution – can help management identify and manage their income and expenses in ways generic accounting solutions like QuickBooks are simply not capable of doing.

Across the private capital spectrum – private debt, private equity, venture and real estate – fund managers are, and will face numerous challenges across their investments, operations and communications. The timely flow of information between all parties cannot be overstated. Technology, for its part, can play a pivotal role in facilitating that flow of information across the back office, deal teams and IR.

Interested in learning more?

Request a demo to find out how Allvue’s software solutions can better inform your investment decisions.