By: Kimberly Kale

Head of Product - Back Office

March 17, 2022

In most scenarios, limited partners (LPs) intend to meet their capital obligations and stay committed to their fund until the GPs sell the entity or take it public. But a lot can change over the course of three or even 10 years and LPs may need to exit their obligation via a partner transfer, one of the standard logistical challenges faced by fund managers and administrators.

What is a limited partner transfer?

A transfer of partnership interest is exactly what it sounds like: the transfer of ownership and future obligations – including capital calls – from one limited partner in exchange for liquidity. In some cases, the transfer can be agreed upon via a pledge, with the actual logistics taking place at a later date. The transferee (the “replacement” investor) can be an existing LP in the fund who assumes a larger share of ownership, or a new investor entirely.

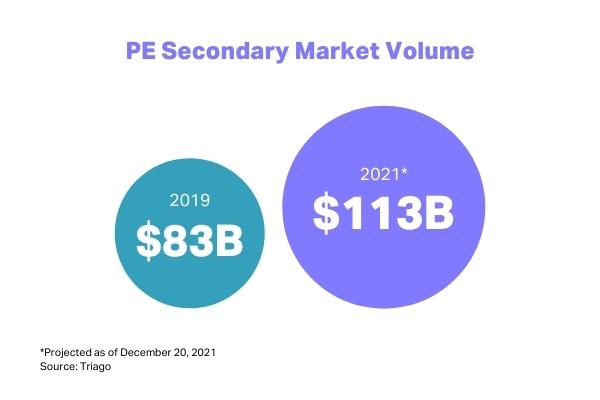

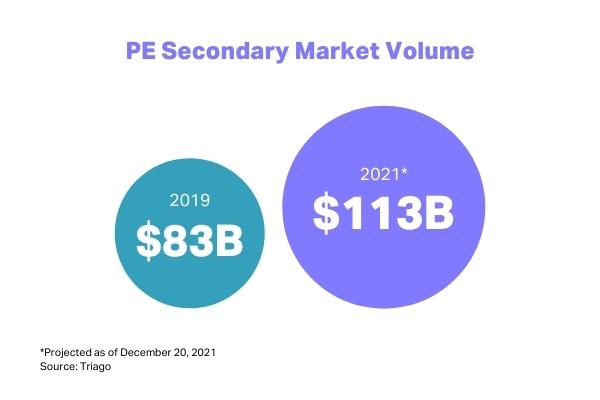

Transactions – especially those with new LPs – may occur on the secondary market, which has seen a surge in activity of late. The volume of the private equity secondary market topped $110 billion in 2021, surpassing the $100 billion level for the first time to notch a record high.

When considering a partner transfer, regardless of who the new LP is, the GP typically has the right of first refusal. All transactions are unique, but generally, they only process with the explicit consent and permission of the fund manager.

In many ways, this transaction is analogous to a sublease; it’s up to the original LP to provide the initial vetting of their replacement and agree upon financial terms of the transfer between them. The GP – who sees no financial impact on their side – must agree to the deal before it moves forward.

And just like a landlord usually runs a credit check on a sublessee, the fund manager will go through a KYC process or other due diligence on any proposed transferee.

DOWNLOAD INFOGRAPHIC: How to Complete a Capital Call in 10 Minutes

Why do partner transfers happen?

There are several reasons why a limited partner may wish to exit their obligation to a fund. Among them:

In many cases, it’s a desire for early liquidity related to cash flow or asset allocation needs. The LP may be hoping to avoid a situation where they default on their commitment (or reacting to a default that has already happened).

A change to the LPs’ business strategy can also prompt a transfer of partnership interest ahead of a rebalance.

Shifts in the regulatory or tax environment are additional culprits.

Finally, a partner transfer can also be initiated by the general partner. In cases when the GP feels a particular LP’s involvement could have an adverse effect on the fund, the GP itself, or any tangential entities, a partner transfer is a potential solution.

What are the challenges of partner transfers?

While not an issue for the GP or fund administrator to wrestle with, the pricing negotiation is complicated. The substitute buyer typically acquires the original LP’s stake at a discount to the fund manager’s most recent valuation of portfolio companies. In fact, the average discount is 14% of the net asset value. This discount is in exchange for the liquidity the transferring LP seeks and helps offset potential management fees down the road.

Getting the blessing from the general partner is a critical step to a successful, seamless partner transfer, but it’s not the only potential stumbling block, and the process can take months to complete. The LPs and GP may need to work with their legal teams to address to amend conditions or restrictions in the original limited partnership agreement, for example.

And if it’s a situation when the LP is at risk of defaulting on their remaining capital commitment, the GP may need to assist with finding and vetting potential buyers. This takes time and manpower, and perhaps the hiring of a third-party agent, which should be factored into the pricing negotiations.

How can fund managers execute partner transfers more confidently?

The above example is almost as simple as these transactions get. As deals become more complicated (and increasingly frequent), the transaction could take accountants days to complete if they’re just using spreadsheets to process the finances behind the handoff.

Partner transfers via Excel are labor-intensive and potentially chaotic, not to mention prone to human error. Having an automated system assist is very valuable for your team and your GP clients.

The process automatically reallocates all transactions that comprise the transferring partner’s capital account balance to the transferee(s). This includes any non-general-ledger events as part of the reallocation logic and can also reallocate transactions after the transfer date from the original partner to the substitute.

Allvue’s Fund Accounting solution manages transfers (including historical transactions) in a single click. The process saves time, eliminates the risk of manual error, and ensures limited-to-no disruption for the GP as the transfer takes place behind the scenes.

Contact us to see how Allvue’s solutions can help general partners and fund administrators address this and other challenges unique to the alternatives market.

More About The Author

Kimberly Kale

Head of Product - Back Office

Kimberly is responsible for back office product management at Allvue. She joined Allvue’s predecessor, AltaReturn, in 2009 and has over 25 years of software management, including 18 years servicing the alternative investments industry. Prior to joining AltaReturn, Kimberly spent seven years with FIS/Investran, first in New York, and then transferring to London to manage the EMEA implementation team. She began her career at KPMG Public Services practice in Washington, DC, and moved on to implement ERP solutions for various insurance and healthcare clients. Kimberly holds a Bachelor’s degree from Vanderbilt University and is currently based in Allvue’s Miami headquarters.