By: James DiCostanzo

Sales Director

April 28, 2023

The private equity and venture capital industries have grown rapidly in recent years, with more investors than ever seeking to invest in these asset classes. While this is great news for fund managers, it has also created a shortage of qualified accountants. As reported by Bloomberg Tax, there was a 17% drop in employed accountants and auditors from 2019 to 2021.

The accounting industry have responded by attempting to win over young talent by changing the image of the industry, but for fund managers, the effect is immediate and meaningful – it puts significant pressure on already strained accounting and back-office teams.

In this article, we outline how this shortage is challenging GPs, including via heightened key-man risk and other stressors, and look at what fund managers can do to continue to ensure accurate and timely financial reporting.

DOWNLOAD NOW: SAMPLE PRIVATE EQUITY REPORTING TEMPLATES

The role of accountants in private equity and venture capital

Accountants play a critical role in both PE and VC, as they are responsible for preparing financial statements, tracking investments, and ensuring compliance with regulatory requirements. Additionally, they play a key role in due diligence and portfolio management activities, providing valuable insights into a company’s financial health and identifying areas for improvement.

The accountant’s role is even more niche in these industries as the illiquidity and complexity of venture capital and private equity fund accounting requires further specialization. As a result, the broader ongoing accountant shortage trend has an outsized ripple effect on the industry.

Why is there a shortage of accountants?

Despite the importance of accountants in the private equity industry, there is currently a shortage of qualified professionals. This shortage is due to several factors, including increased demand for accounting services and a lack of skilled professionals entering the field.

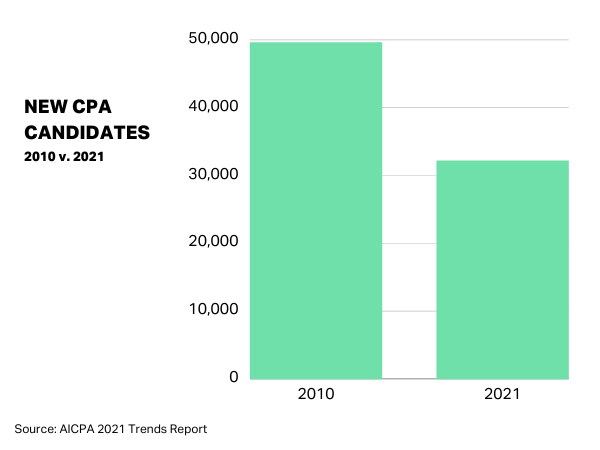

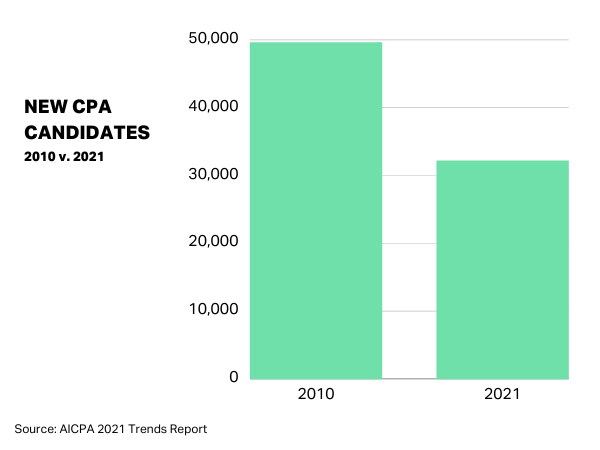

As the AICPA reported in its 2021 trends report, there has been a significant reduction in the number of college graduates earning a bachelor’s or master’s degree in accounting, dropping 4% since the onset of the COVID-19 pandemic, with a similar reduction in the number of graduates sitting for the Uniform CPA Examination over that same time period. Even more startlingly, while there were almost 50,000 candidates in 2010, that number sunk to just over 32,000 in 2021.

The Decline in New CPA Candidates

As a result, fund managers are struggling to find qualified candidates to fill open positions, putting stress on their accounting and back-office teams.

The accountant shortage heightens key-man risk

The shortage of accountants is particularly concerning for GPs as it increases key-man risk.

Key-man risk refers to the risk that a critical team member, such as an accountant, holding substantial knowledge regarding firm practices, processes, and history, leaves the firm unexpectedly, thereby disrupting operations and potentially impacting performance. It is, in one sense, akin to losing access to key data. When a key team member leaves, the data may remain but the knowledge and processing skills required to action that data disappear.

With a shortage of qualified accountants, the risk of losing a critical team member is significantly higher, putting fund managers at risk.

What can GPs do about the accountant shortage?

To address the shortage of accountants and reduce potential issues like key-man risk, GPs can take several steps.

Streamline in-house processes

One approach is to streamline in-house processes to make accounting and back-office activities as efficient and risk-free as possible. This can include investing in technology to automate manual tasks, such as data entry and reconciliation, thus freeing up accountants to focus on higher-level activities.

Outsource back-office workflows

Another approach is to outsource accounting and reporting activities to third-party fund administrators. These firms specialize in providing accounting and administrative support to VC and private equity funds, allowing fund managers to focus on their core investment activities. Outsourcing can also provide access to a broader pool of skilled professionals, reducing key-man risk.

Implement co-sourcing

Co-sourcing is a new, hybrid fund administration model that has been recently gaining traction. With co-sourcing, fund administrators execute their GP clients’ accounting and reporting activities directly on that GPs software instance. As a result, fund managers maintain easy access to their data while still being about to outsource their accounting and reporting.

Leverage technology

Finally, GPs can leverage technology to streamline back-office workflows and accounting and reporting processes. Technology solutions, such as cloud-based accounting software and data management tools, can automate manual tasks, improve data accuracy, and provide real-time, drill-through reporting, enabling fund managers to make more informed investment decisions.

Leveraging technology to streamline back-office workflows and accounting and reporting processes provides several benefits to firms. Firstly, it improves efficiency, enabling accountants to focus on higher-level activities such as financial analysis and due diligence. Secondly, it reduces errors and improves data accuracy, providing more reliable financial information for decision-making. Finally, it enables real-time reporting, providing fund managers with the insights they need to make informed investment decisions quickly.

READ MORE: THE RISKS OF EXCEL FOR PRIVATE EQUITY ACCOUNTING

Allvue can help alleviate the stress of the accountant shortage

The shortage of accountants is a significant challenge for the private equity and venture capital industries, putting stress on accounting and back-office teams and increasing key-man risk. Allvue’s award-winning Fund Accounting software solution can meaningfully alleviate this challenge, by providing both enterprise and emerging managers with access to best-in-class technology.

Allvue sets itself apart from the competition by:

- Providing access to a platform built on Microsoft – This ensures that our cloud-based platform is able to stay up to date without requiring costly upgrades.

- Offering private capital managers purpose-built solutions – Our Fund Accounting solution is a true general ledger that was built specifically for the needs of private capital managers, an essential component when dealing with the specialized needs of this niche asset class.

- Providing powerful software that flexes – Our software can be implemented in-house, leveraged by a fund administrator, or employed in co-sourcing model

If you are feeling the burden of the current accounting shortage, reach out today to discover how Allvue can help you keep growing your business while empowering superior investment decisions.

More About The Author

James DiCostanzo

Sales Director

James DiCostanzo is a global sales leader with over 20 years of experience in the financial, private equity and SaaS industries. He is currently the Global Head of Growth Equity Sales at Allvue Systems, a leading provider of investment management solutions. He joined Allvue Systems in March 2020 as the Head of Sales for the East Region, after working at Thomson Reuters for nearly two decades in various roles, including Head of Solution Specialists, Data & Analytics and Global Business Director. He has a bachelor’s degree in Business/Managerial Economics from SUNY Oneonta. He is based in the New York City Metropolitan Area and can be found on LinkedIn at https://www.linkedin.com/in/jamesdicostanzo/.