By: Allvue Team

January 18, 2022

It’s indisputable: cryptocurrency has gone mainstream.

Crypto.com — which already hired Oscar winner Matt Damon as a spokesperson and snatched up naming rights for the L.A.-based Staples Center — secured an ad spot for the 2022 Super Bowl.

Not to be outdone, cryptocurrency exchange FTX has its own celebrity spokes-couple (Tom Brady and Gisele Bundchen), its own named arena (home to the Miami Heat), and is also working on a spot for the Big Game. A single 30-second spot is expected to cost at least $6.5 million this year, per The Wall Street Journal.

How big is the crypto industry?

The competition to get their brands in front of the world’s biggest TV audience is more proof that cybercurrency has quickly evolved from a supposed fad (or punchline) to a sought-after investable asset class.

In 2021, more than 30 unicorns (companies worth at least $1 billion) were created in the sector, according to Crunchbase. And the crypto industry is growing so quickly that the number of active players is a rapidly moving target. Per the latest from Statista, there are nearly 7,600 cryptocurrencies worldwide, trading on more than 300 currency exchanges.

Global adoption of cryptocurrency specifically surged 880% year-over-year from Q2 2020 to Q2 2021. As more investors get buy/sell/send access – like through the WhatsApp platform – the trend will likely continue.

“There’s a lot of people saying crypto is a fad, just the way they said the internet was a fad … Crypto is really the basis of the next version of the internet.”

— Steven Kalifowitz, Crypto.com CMO, as told to The Wall Street Journal

How active are venture capitalists in the crypto industry?

Four years ago (Q1 2018), 80% of crypto transactions were initiated by retail investors, according to Coinbase. By Q1 of 2021, the paradigm had shifted, and 72% of all crypto trades were driven by institutional traders.

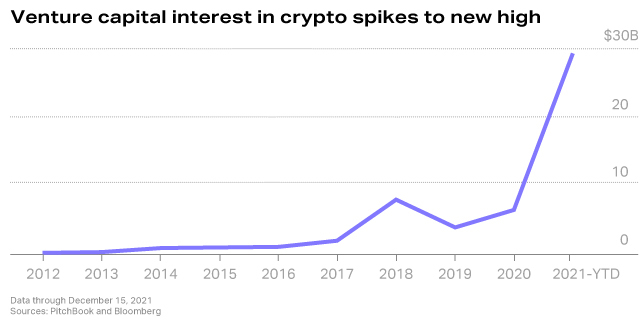

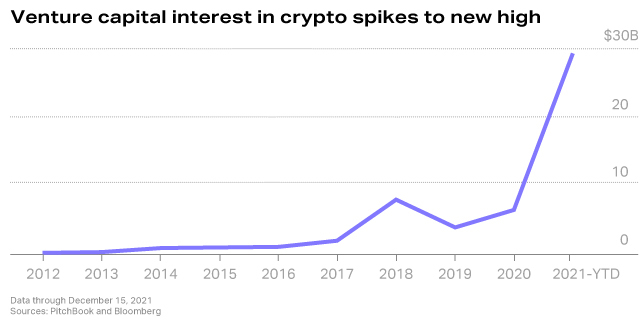

Venture capital firms, in particular, are exploring crypto as a new investment opportunity. In fact, the crypto sector attracted roughly $30 billion in VC funds during 2021, more than all previous years combined (2012 – 2020) and the sector’s market cap surged from $800B to $2.2T.

Per data from Hutt Capital, the sheer number of blockchain-dedicated VC funds has also grown, from 49 in Q2 2019 to 79 in Q2 2021, with the average fund size expanding as well ($78M to $86M).

Even so, there is ample room – and appetite – for yet more venture capital investment. The majority (62%) of institutional investors who don’t yet have exposure to the crypto sector are planning to change that this year, according to a Nickel Digital Asset Management survey.

DOWNLOAD INFOGRAPHIC: 6 Venture Capital Trends to Watch in 2022

Pros of cryptocurrency trading for venture capital firms

There are several factors driving this heightened interest among today’s VC leaders. Among them:

Growth potential: As Damon quips in his Crypto.com spot, “Fortune favors the bold,” and the cryptocurrency space is replete with examples of impressive rewards.

VC firm Andreessen Horowitz invested $20M in Coinbase in 2013; the same stake is valued at $11B today, according to The New York Times.

Innovation: Many pundits expect crypto to be foundational to the next version of the internet, also known as Web3: a decentralized space based on the blockchain. VC firms have long prided themselves on being on the ground floor of new technology and crypto is certainly that, at least for now.

Flexibility and liquidity: Because crypto investing is typically executed via tokens versus shares, the currency gives VC firms far more flexibility (and greater opportunity to liquidate) than traditional VC funding methods.

Challenges of cryptocurrency trading for venture capital firms

But as with all investments, the advantages are not without tradeoffs. Here are a few considerations for venture capitalists looking for how to invest in crypto:

Precise calculations: Cryptocurrency is calculated out to 18 decimal places, introducing a greater potential for errors and making bookkeeping extremely complex. Even if your firm is using accounting software instead of Excel, it may lack the capacity to accurately calculate this number of decimal places.

Volatility: Like other alternative investments, cryptocurrency can be challenging to track as part of a larger portfolio. It’s notoriously volatile; case in point, Bitcoin’s value swung from over $67,000 on November 8, 2021, to under $47,000 six weeks later.

Heightened regulation: As access to and interest in the asset expands, increased regulatory and compliance measures are likely to follow. The Chinese government has made crypto trading essentially illegal, while the US Treasury Department has been advocating for stricter guidelines that would help reduce potential tax evasion risks. This increased regulation means accurate record-keeping will be more important than ever.

READ MORE: 5 Steps Emerging Private Equity & Venture Capital Firms Can Take to Accelerate Growth

Technology can help set you up for crypto success

Having end-to-end venture capital portfolio management software in place can ensure accuracy and deliver a reliable investor experience, regardless of the number of assets or currencies being traded. Allvue’s tools are sophisticated enough to handle the unique challenges of tracking crypto transactions, so you can feel confident in your accounting and reporting results.

Learn how Allvue can provide the right solutions for making superior investment decisions.