-

Private Equity

Private equity and venture capital managers

-

Credit

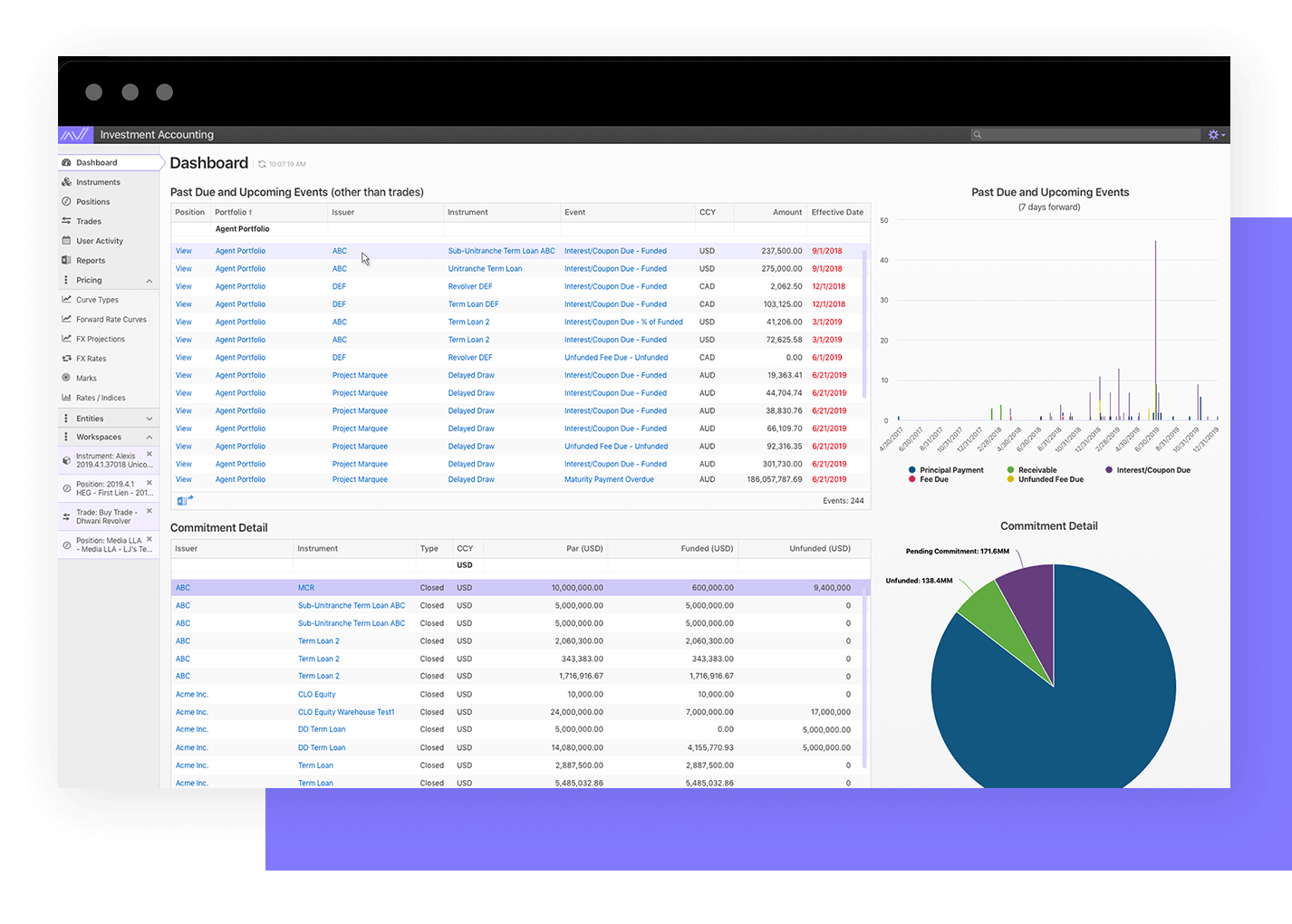

Private debt, CLOs, and public credit

-

Fund Administrators

Fund administrators serving private capital

Back Office

Investor Relations

Investment Management

Data Management

Front Office

Investor Relations

Back Office

Technology Partner

Data Management

Back Office

Data Management

Investor Relations

Data Collection

Purpose-built for your investment strategy and fund lifecycle

Investment Stategy

Emerging Managers

Diversified Managers

Allvue monthly newsletter

Sign up to receive regular updates on Allvue's content, award wins, product releases, and more.

Allvue monthly newsletter

Sign up to receive regular updates on Allvue's content, award wins, product releases, and more.

Allvue

- BACK

- Private Equity

- Back Office

- Investor Relations

- Investment Management

- Data Management

- REQUEST A DEMO

- BACK

- Credit

- Front Office

- Investor Relations

- Back Office

- Technology Partner

- Data Management

- REQUEST A DEMO

- BACK

- Fund Administrators

- Back Office

- Data Management

- Investor Relations

- Data Collection

- REQUEST A DEMO

- BACK

- Who We Serve

-

- Private equity

- Venture capital

- Private debt

- CLOs

- Fund of funds

Investment Stategy

- Private equity

- Venture capital

- Private debt

- Fund administration

Emerging Managers

- Credit Research Solutions

Diversified Managers

-

Purpose-built for

your investment strategy and fund lifecycle - REQUEST A DEMO

- BACK

- Resources

-

Allvue monthly newsletter

Sign up to receive regular updates on Allvue's content, award wins, product releases, and more.

- REQUEST A DEMO

- BACK

- Company

-

- About us

- Leadership

- Partners

- News

- Careers

- Contact us

Allvue

- Carry & Compensation

- Compensation, Planning & Recommendations

NEW

Allvue + PFA Solutions

-

Allvue monthly newsletter

Sign up to receive regular updates on Allvue's content, award wins, product releases, and more.

- REQUEST A DEMO